Paytm Payments Bank is all set to launched today i.e. 23 May 2017. This will be a awesome news for all the future paytm bank account holder as they provide benefits like interest on wallet money, no minimum balance, zero fee on online transactions etc. If you want to transfer paytm wallet money to bank account then head over to this article : How to Transfer Paytm Wallet Money To Bank Account.

Here in this article, I am going to discuss everything in detail related to paytm payments bank and most frequently asked questions about paytm bank account.

For FAQs on Paytm Payments Bank, Scroll to the below of this article 🙂

About Paytm : Paytm was founded in 2010 by Vijay Shankar Sharma under the name of One97 company. At that time, It was only a recharge website through which you can recharge your mobile etc. But slowly they start adding more services like Movie ticket booking, Train ticket booking, Flight ticket booking and now they are launching their own bank. They have come a long way from a recharge website to Bank.

Before going further, Lets us know What is Paytm Payments Bank and how it is different from other bank and its advantage over other conventional bank.

What Is Paytm Bank??

Payments Bank is a new type of bank, licenced by the Reserve Bank of India. As a Payments Bank, Paytm can now accept customer deposits upto Rs. 1 lakh per customer in a wallet, savings or current account and offer other banking services like Debit Cards, Online Banking and Mobile Banking.

How is Paytm Payments Bank different from a normal bank?

Advantages Of Paytm Payments Bank

There are many advantage of opening Paytm bank account over other conventional bank. Some of the benefits have been listed below.

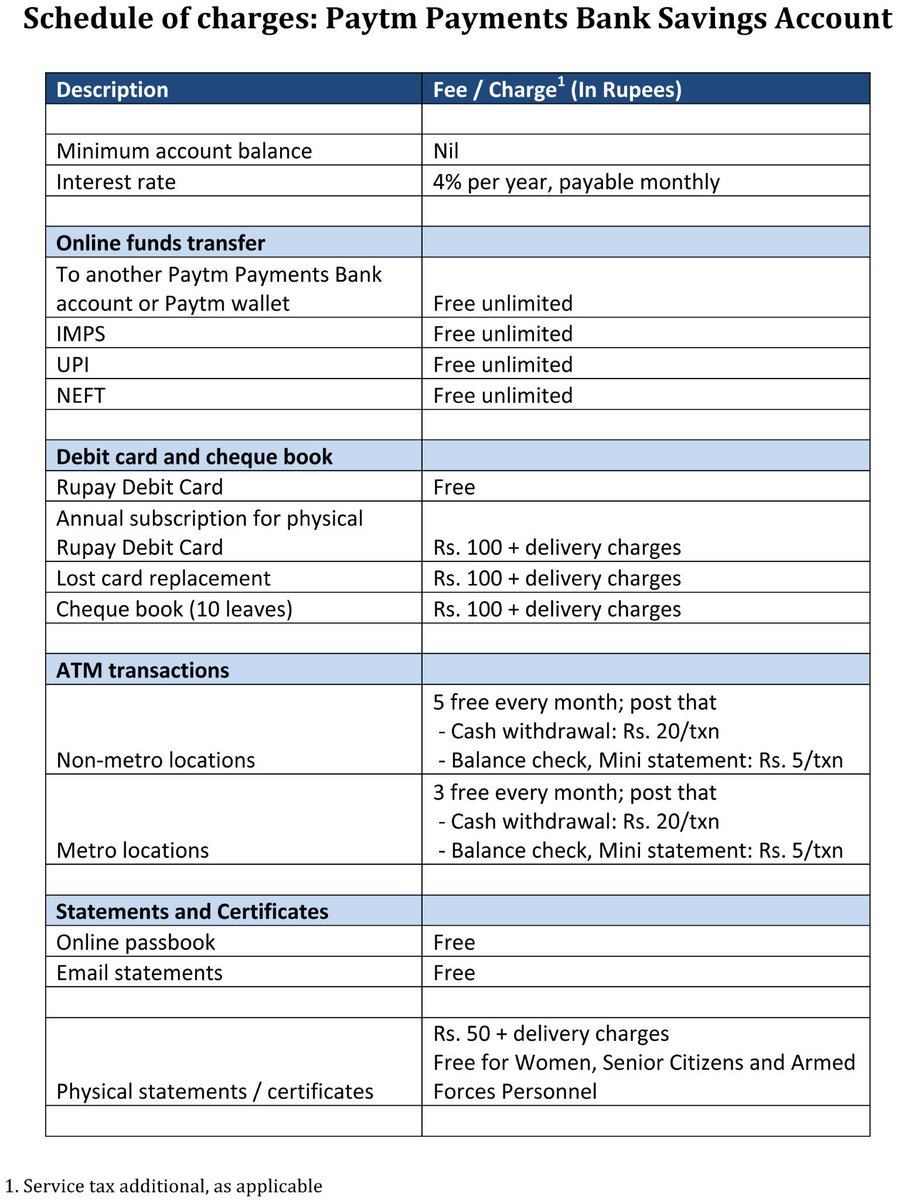

- It will offer an annual interest of 4% for all savings accounts and is payable monthly.

- The account will have zero balance requirement and every online transaction (such as IMPS, NEFT, UPI) will be free of charge.

- Physical services like chequebook, demand draft and debit card will be available at a nominal fee, benchmarked to the industry.

- The bank will also offer a cashback of Rs 500rs to customers depositing Rs 25,000 in the payment bank.

How To Apply For Paytm Bank Account?

As of now, Paytm is inviting only some of its users to open PAYTM bank account. So Before opening a new bank account on Paytm You have to request for Paytm Bank Invite. Once its get approved you will get a link to open paytm bank account.

After requesting for invite You will have an option to open bank account and access a range of other financial services by completing your KYC and signing up digitally.

How To Request For Paytm Bank Invite?

1. First of all, Go through this link Click Here

2. Now there you will see a option “Request An Invite”. Click on this.

3. After that log in to your account.

4. Now fill all the details and submit it.

After submitting it, You will get this “Thank you for your interest in Paytm Payments Bank. We will inform you once your invite is ready”.

That’s it. You have successfully requested for the Paytm Bank Payments Invite. Once your invite is ready you will get the link to open your bank account detail.

Paytm Bank Schedule Of Charges

PAYTM Payments Bank ATM Transaction Charges :

- For Non Metro locations, you can do 5 transaction every month for free. Post that “For Cash Withdrawal” you will be charged Rs 20 per transaction and for “Balance Check & Mini Statement” you will be charged Rs 5 per transaction.

- For Metro Locations, You can do 3 transaction every month for free. Post that “For Cash Withdrawal” you will be charged Rs 20 per transaction and for “Balance Check & Mini Statement” you will be charged Rs 5 per transaction.

Paytm Bank Account Summary

- Type Of Account : Savings Account

- Minimum Account Balance: Nil

- Maximum Balance : Rs 100000

- Money Withdrawal from ATM Allowed: Yes

- Online Fund Transfer to another paytm payments bank or paytm wallet : Free And Unlimited

- Paytm Payment Bank Interest Rate : 4% per annum. It will be paid monthly.

- Debit Cards : Yes

- IMPS, NEFT Available : Yes [Free & Unlimited]

- UPI Available : Yes [Free & Unlimited]

- Banking Transaction Charges: Free of Cost

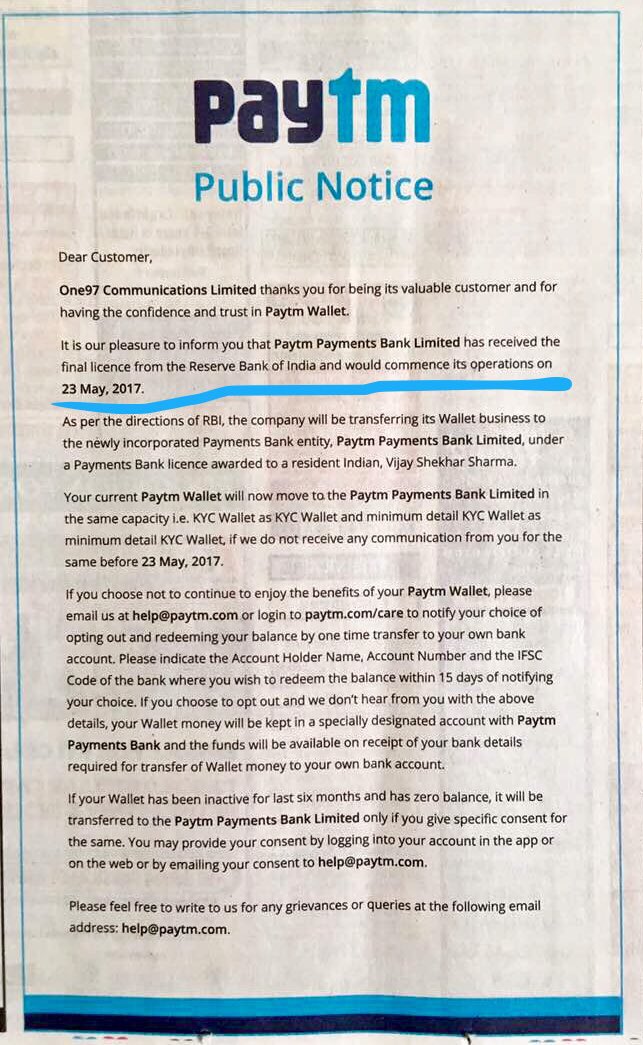

Paytm Public Notice For Paytm Bank Payments

The text in the image is :

Dear Customer.

One97 Communications Limited thanks you for being its valuable customer and for having the confidence and trust in Paytm Wallet.

It is our pleasure to inform you that Paytm Payments Bank Limited has received the final license from the Reserve Bank of India and would commence its operations on 23 May 2017.

As per the directions of RBI, the company will be transferring its Wallet business to the newly incorporated Payments Bank entity, Paytm Payments Bank Limited, under a Payments Bank license awarded to a resident Indian, Vijay Shekhar Sharma.

Your current Paytm Wallet will now move to the Paytm Payments Bank Limited in the same capacity i.e. KYC Wallet as KYC Wallet and minimum detail KYC Wallet as minimum detail KYC Wallet, if we do not receive any communication from you for the same before 23 May 2017.

If you choose not to continue to enjoy the benefits of your Paytm Wallet, please email us at help@paytm.com or log in to paytm.com/care to notify your choice of opting out and redeeming your balance by one-time transfer to your own bank account. Please indicate the Account Holder Name. Account Number and the IFSC Code of the bank where you wish to redeem the balance within 15 days of notifying your choice. If you choose to opt out and we don’t hear from you with the above details, your Wallet money will be kept in a specially designated account with Paytm Payments Bank and the funds will be available on receipt of your bank details required for transfer of Wallet money to your own bank account.

If your Wallet has been inactive for last six months and has zero balance, it will be transferred to the Paytm Payments Bank Limited only if you give specific consent for the same. You may provide your consent by logging into your account in the app or on the web or by emailing your consent to helpepaytm.com.

Please feel free to write to us for any grievances or queries at the following email address help@paytm.com.

It is our pleasure to inform you that Paytm Payments Bank Limited has received the final license from the Reserve Bank of India and would commence its operations on 23 May 2017.

As per the directions of RBI, the company will be transferring its Wallet business to the newly incorporated Payments Bank entity, Paytm Payments Bank Limited, under a Payments Bank license awarded to a resident Indian, Vijay Shekhar Sharma.

Your current Paytm Wallet will now move to the Paytm Payments Bank Limited in the same capacity i.e. KYC Wallet as KYC Wallet and minimum detail KYC Wallet as minimum detail KYC Wallet, if we do not receive any communication from you for the same before 23 May 2017.

If you choose not to continue to enjoy the benefits of your Paytm Wallet, please email us at help@paytm.com or log in to paytm.com/care to notify your choice of opting out and redeeming your balance by one-time transfer to your own bank account. Please indicate the Account Holder Name. Account Number and the IFSC Code of the bank where you wish to redeem the balance within 15 days of notifying your choice. If you choose to opt out and we don’t hear from you with the above details, your Wallet money will be kept in a specially designated account with Paytm Payments Bank and the funds will be available on receipt of your bank details required for transfer of Wallet money to your own bank account.

If your Wallet has been inactive for last six months and has zero balance, it will be transferred to the Paytm Payments Bank Limited only if you give specific consent for the same. You may provide your consent by logging into your account in the app or on the web or by emailing your consent to helpepaytm.com.

Please feel free to write to us for any grievances or queries at the following email address help@paytm.com.

Frequently Asked Questions (FAQs) Related To Paytm Payments Bank

Q. How is a Payments Bank different from a conventional bank?

Payments Bank is a new bank model visualised by the Reserve Bank of India. As a Payments Bank, Paytm can now accept customer deposits upto Rs. 1 lakh per customer in a savings or current account and offer other banking services like Debit Cards, Online Banking and Mobile Banking.

Payments Banks can not offer financial products of their own, but partner with other banks.

Q. What are the services offered by Paytm Payments Bank?

Paytm Payments Bank is offering savings and current accounts with a debit card and the ability to make fast and easy payments. It will soon enable you to access a range of financial services such as Insurance, Loans, Mutual Funds offered by our partner banks with the seamless Paytm experience.

Q. How can I open my account?

Currently we are inviting limited users to open an account with Paytm Payments Bank. You can request for an invite using paytmpaymentsbank.com or the latest Paytm app.

Q. What happens to my existing Wallet?

Your current Paytm Wallet will now move to the Paytm Payments Bank Limited in the same capacity i.e. KYC wallet as KYC wallet and minimum KYC wallet as minimum KYC wallet. You continue to use the Paytm Wallet as before without any changes.

However, if you have not used your wallet in the last 6 months and you have zero balance, you will be required to login to your wallet again to move to the Paytm Payments Bank.

Q. I see a text in my passbook about older transactions being from wallet under One97, what does this mean?

Your Paytm Wallet has moved from One97 Communications Ltd. to Paytm Payments Bank Limited as per the directions of RBI. The transactions you see under ‘wallet issued by One97 Communications Ltd.’ are the transactions made by you before your wallet moved to the Paytm Payments Bank.

Q. Will my wallet get converted into a bank account?

No, your wallet will simply operate under the Paytm Payments Bank and continue to exist and function in the same manner as earlier. In addition to a wallet, you will now be able to open a savings or current account with us and access a wide range of financial services.

Q. Can I choose not to move to Paytm Payments Bank?

Movement to Paytm Payments Bank is required by RBI for all Paytm Wallet customers. However, If you choose not to continue to enjoy the benefits of your Paytm Wallet, please email us at care@paytmpaymentsbank.com

If you chose not to migrate to Paytm Payments Bank, your wallet will be closed and you will not be able to make payments using your Paytm Wallet.

Q. Will my wallet balance now earn interest?

To earn interest, you will need to open a Paytm Payments Bank savings account.

Q. I accept Paytm at my store, what does this mean for me?

Your wallet continues to work the same way as before. There is no impact on your cashflows or the mode of accepting payment.

Q. I am expecting a refund on a payment I made from my Paytm Wallet. What happens to the refund now?

Your refunds will be given back to your wallet as earlier.

Q. Will my old login details work?

Yes, your Paytm login details continue to remain the same.

Q. Can I now withdraw money from my wallet?

No, withdrawing money from wallet is not allowed as per RBI policies.

Q. Is it mandatory to open an account with Paytm Payments Bank once it is launched, to continue using the wallet?

It is not mandatory to open an account with Paytm Payments Bank to use the wallet.

Q. Does this mean, I get a bank account with Paytm Payments Bank?

No. This is just a transfer of ownership of the Paytm Wallet to a new company called Paytm Payments Bank Ltd. You will now be given an option to open a separate bank account with us.

Q. Can I move my money to any other Bank from Paytm Payments Bank Wallet?Yes, you would be able to send money to any bank account from your Paytm Payment Bank Wallet.

Q. I already have a Paytm account. Will I automatically become a Bank customer?

While you may be an existing Paytm user, you will need to open a Bank account separately.

Q. I haven’t done my KYC. Can I get a Payments Bank account?

Only KYC-enabled Paytm users are allowed to open a Paytm Payments Bank account. Our KYC process is instant and absolutely paperless — so what are you waiting for? Find your nearest KYC center here or click here to book an appointment at place of your convenience (limited service!)

Final Word On Paytm Payments Bank

Paytm have come a long way from where they started. With the introduction of Paytm bank they have added another milestone in just 7 years of launching of Paytm.

According to me, Paytm Bank is a good forward step by paytm towards the digitalisation. Also if it has many advantage over other conventional bank like no charges on online payment etc. And also it is providing 4% interest rate per year which is payable monthly. As all the other banks have increased the minimum amount balance, Paytm has come with a boon where no minimum balance is required.

That’t it. Hope you like this long article on Paytm Payments Bank. If you still have any query then ask in the comment section below.

No comments:

Post a Comment